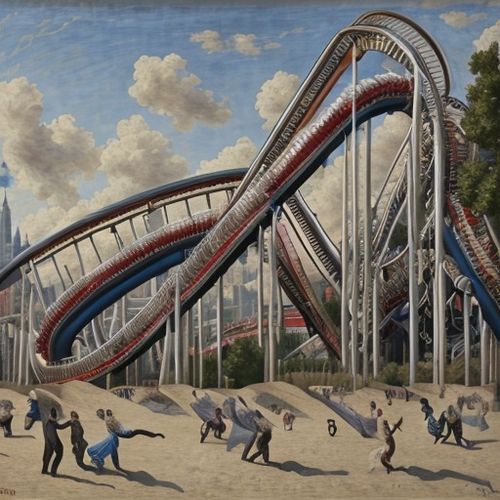

The art investment world has always danced to its own rhythm, but recent data reveals an intriguing pattern - contemporary art funds are exhibiting the most dramatic swings in performance. While Old Masters and Impressionist works plod along with steady single-digit returns, their modern counterparts are delivering rollercoaster rides that would make even cryptocurrency investors pause.

According to the latest Art Fund Annual Review, contemporary art portfolios showed a staggering 28% annualized volatility over the past five years, nearly triple the 10% fluctuation seen in traditional art sectors. This isn't merely about boom-and-bust cycles; it reflects fundamental shifts in how value gets assigned in today's art markets.

Gallery owner Sophie Laurent, who's weathered three art market downturns, observes: "What we're witnessing is the financialization of avant-garde art. The same speculative energy that once fueled tech stocks now chases Basquiat paintings and immersive installations. When sentiment shifts, these assets get repriced violently." Her London gallery has seen works by young artists swing from £20,000 to £200,000 and back within eighteen months.

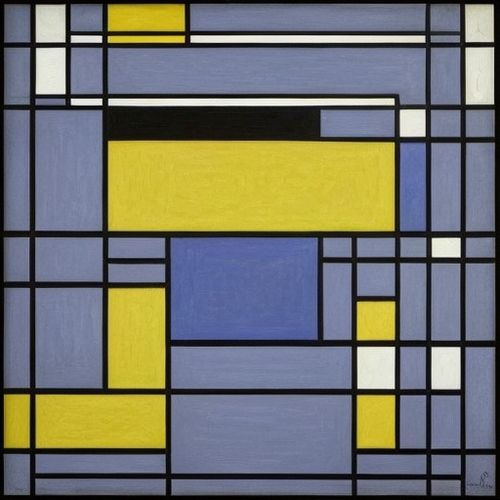

The mechanics behind this volatility reveal much about contemporary art's unique position. Unlike traditional sectors where provenance and scholarly consensus stabilize prices, contemporary art valuations hinge on more mercurial factors - the buzz around an artist's studio, viral museum shows, or even celebrity endorsements. A single Instagram post by a pop star can send an obscure painter's auction prices soaring, while a critical pan in Artforum may trigger equally abrupt corrections.

Market infrastructure compounds these swings. Contemporary art funds frequently trade works by living artists, meaning supply isn't fixed. An artist's sudden productivity surge - or worse, personal scandals - can dramatically alter available inventory. The 2022 case of Jonah Rimes illustrates this perfectly: after his Whitney Biennial showcase, his large-scale installations commanded $150,000; when he subsequently flooded the market with new pieces for tax reasons, prices collapsed to $40,000 within months.

Interestingly, this volatility isn't scaring away investors - it's attracting a new breed. Hedge fund analysts and crypto traders are pouring into contemporary art funds, precisely because the wild swings create arbitrage opportunities. "Traditional art investors want stability," notes Marcus Wei of Pembroke Art Capital. "Our new clients see contemporary art as options trading - they're building complex derivative strategies around these fluctuations."

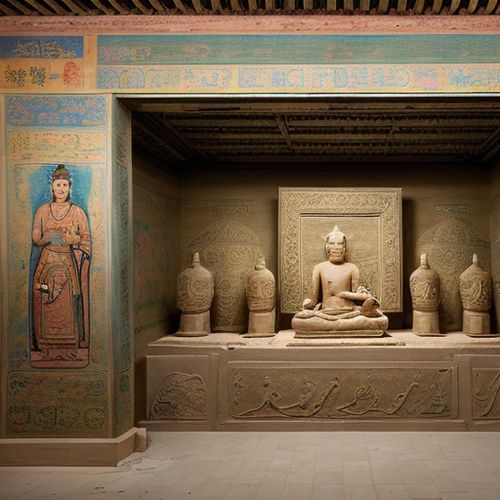

The geographical dimension adds another layer. Contemporary art markets are intensely concentrated in about a dozen global cities, making them hypersensitive to local conditions. A change in Hong Kong's import taxes or New York's zoning laws for artist studios can ripple through prices faster than macroeconomic shifts affect traditional art. During the 2021 Shanghai lockdowns, Chinese contemporary art funds saw 40% volatility spikes as collectors scrambled to reposition.

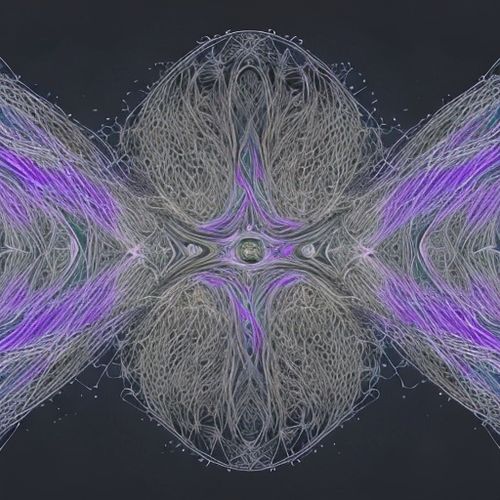

Technology plays a dual role. While blockchain authentication was supposed to stabilize markets, NFT mania actually increased volatility by blurring lines between digital and physical contemporary art. Meanwhile, algorithmic pricing tools - designed to smooth valuations - sometimes amplify swings as funds herd around the same data signals. Last quarter's "algorithmic flash crash" in video art prices occurred when three major funds simultaneously adjusted their valuation models.

Curator Damola Adeyemi argues we're witnessing growing pains: "Contemporary art is learning to function as an asset class while retaining its essential unpredictability. The tension between these identities creates these spectacular price arcs." He points to recent museum acquisitions deliberately targeting artists with volatile market trajectories as institutions seek relevance in financialized culture.

For serious collectors, this environment demands new strategies. Some are building "volatility hedges" by mixing ultra-contemporary positions with mid-career artists showing steadier appreciation. Others are exploiting the time lag between primary (gallery) and secondary (auction) markets - buying hot artists early from studios, then short-selling via auction derivatives. It's a far cry from the buy-and-hold approach of traditional art investing.

The psychological impact can't be overstated. Wild price swings are changing how artists create, with some deliberately producing "volatility-friendly" works - series with slight variations that facilitate rapid trading. Critics decry this as artistic integrity sacrificed to market mechanics, while others see ingenious adaptation. Performance artist Li Wei now creates pieces specifically designed to spike and crash in value, commenting: "My work finally performs like the capitalist theater surrounding it."

Looking ahead, regulators are taking notice. The EU's recent Cultural Asset Stability Act proposes disclosure requirements for art funds holding works by artists under 50. Meanwhile, tax authorities increasingly scrutinize volatility-driven strategies like "art washing" - using dramatic value swings to obscure money flows. Some predict contemporary art funds may soon face the same oversight as hedge funds.

Paradoxically, this turbulence may benefit the art itself. Historians note that previous periods of extreme market volatility - like 1980s Neo-Expressionism or the 2008 YBA selloff - often preceded creative explosions. When financial certainty dissolves, artistic risk-taking flourishes. The paintings being traded so violently today might tomorrow be recognized as masterpieces born from this crucible of instability.

For investors, the message is clear: contemporary art funds offer thrilling potential but demand steel nerves. As markets evolve, one constant remains - in art as in finance, extraordinary rewards still favor those who can stare down extraordinary uncertainty. The difference now is that the uncertainty comes with an artist's statement and exhibition history attached.

By Amanda Phillips/Apr 12, 2025

By Christopher Harris/Apr 12, 2025

By Laura Wilson/Apr 12, 2025

By Olivia Reed/Apr 12, 2025

By Daniel Scott/Apr 12, 2025

By James Moore/Apr 12, 2025

By Jessica Lee/Apr 12, 2025

By Benjamin Evans/Apr 12, 2025

By William Miller/Apr 12, 2025

By Daniel Scott/Apr 12, 2025

By Elizabeth Taylor/Apr 12, 2025

By Joshua Howard/Apr 12, 2025

By William Miller/Apr 12, 2025

By James Moore/Apr 12, 2025

By Elizabeth Taylor/Apr 12, 2025

By Sarah Davis/Apr 12, 2025

By Christopher Harris/Apr 12, 2025

By George Bailey/Apr 12, 2025

By John Smith/Apr 12, 2025

By Christopher Harris/Apr 12, 2025